BEIJING — Chinese President Xi Jinping met with top U.S. executives in Beijing Wednesday, as his government tries to reassure foreign businesses about a market that remains crucial for their bottom lines despite persistent tensions between the world’s two biggest economies.

Xi met the group of American businesspeople and academics at the Great Hall of the People, Chinese state media reported. The meeting was preceded by a group photo.

Participants included Blackstone founder Stephen Schwarzman, Bloomberg Chair Mark Carney, FedEx President Rajesh Subramaniam and Qualcomm President and CEO Cristiano Amon, according to state media reports.

During the meeting, Xi said the Chinese economy was “healthy and sustainable,” an achievement that “cannot be separated from international cooperation,” according to state media, which reported that he “listened carefully” to the American participants.

The executives were in China for a series of business-related events including the China Development Forum, an annual high-level meeting that ended Monday. Other prominent U.S. business leaders such as Apple CEO Tim Cook have also been in China in recent days, as the government and American companies engage in a mutual charm offensive.

China has been struggling to bounce back from three years of pandemic isolation, its economic recovery weighed down by structural issues including a real estate crisis, high local government debt, industrial overcapacity, lackluster consumption and youth unemployment, though the economy managed a 5.2 percent growth rate last year.

“The mood here is still pretty dark — about the economy, about the trajectory of the country overall, about China’s place in the world,” Scott Kennedy, senior adviser and Trustee Chair in Chinese Business and Economics at the Center for Strategic and International Studies (CSIS) in Washington, said in an interview in Beijing last week.

“There’s been some economic recovery, but it has not translated into people having more positive, optimistic sentiment,” he said.

U.S. and other foreign companies who still see the potential for big business in China, meanwhile, have been alarmed by regulatory crackdowns, a new anti-espionage law, the use of exit bans, raids on consulting and due diligence firms, and other measures amid Xi’s national security drive.

“China’s success the last 40 years has been built on the private sector and openness and collaboration with the West,” Kennedy said. “And so people’s sense of the future is very unclear and ambiguous, and I think that’s what’s leading consumers to not spend as much, companies not to invest as much and for there to be this general malaise that you encounter just about everywhere you go.”

During a visit to China last year, Commerce Secretary Gina Raimondo said U.S. firms had told her the country was “uninvestable because it’s become too risky.”

And a report released in February by the American Chamber of Commerce in China found that the top concerns of U.S. businesses in the country were U.S.-Sino relations as well as China’s regulatory environment and rising costs.

Hopes rose in November when Xi and President Joe Biden held a summit in California, their first encounter in a year. During that trip, Xi also met with U.S. business leaders at a dinner in San Francisco, where he received a standing ovation.

Among the attendees at that dinner was Apple CEO Cook, a frequent traveler to China who arrived for another high-profile visit last week.

Even as the company shifts some production to countries such as India, Cook emphasized on this visit that Apple is still committed to China, a key overseas market for the company as well as a major manufacturing base.

For the first time last year, Apple was China’s largest smartphone vendor, with market share of 17.3%. But the company is under intense pressure from domestic competitors such as Huawei, and iPhone sales reportedly fell by 24% in the first six weeks of this year compared with a year earlier.

The use of iPhones at Chinese government agencies and state-owned enterprises has also reportedly been restricted amid national security concerns, much like the Chinese app TikTok has been banned from U.S. government devices.

Those are not the only challenges facing Apple, which was sued by the U.S. Justice Department on Thursday over its alleged monopolization of the smartphone market.

Earlier that day, Cook was all smiles as he opened a new Apple store in downtown Shanghai, the company’s 57th outlet in China and its second-largest flagship in the world after its Fifth Avenue location in New York.

Cook said he was “very confident” in the future of Apple’s China operations. “I love being here. I love the people and the culture,” he told reporters. “And it’s just like every time I come here, I’m reminded that anything is possible here.”

Though Cook was mobbed by fans at the store opening, where some people had lined up overnight, that doesn’t necessarily translate into sales. The economic downturn appears to be making Chinese consumers more price-sensitive, increasing the appeal of cheaper smartphones from Huawei and other local rivals.

“The iPhone is more expensive than other phones, so I think people will choose cheaper ones,” Shi Zhongnuo, 17, said in an interview Monday outside an Apple store in Beijing.

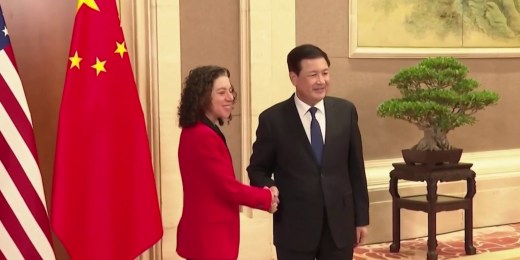

Cook also met with Commerce Minister Wang Wentao, who urged him to “continue to unlock the Chinese market and achieve shared development with China,” according to a ministry statement.

It was unclear whether Cook attended the meeting with Xi on Wednesday.

But China’s courting of executives is in part an effort to revive business interest from abroad. The country’s foreign direct investment fell 19.9% in the first two months of this year to 215.1 billion renminbi ($30 billion), the Commerce Ministry reported last week, after shrinking 8% year-on-year in 2023.

“There’s still huge numbers of multinationals and American companies here, but China has basically lost its place at the very top of the list of where they are targeting strategic investment long term,” Kennedy of CSIS said.

A Chinese regulatory official on Tuesday dismissed the drop in foreign investment as nothing unusual.

“The volatility is quite normal when viewed from a global or Asian perspective, or when the trend is viewed on a longer timeline,” Xu Zhibin, the deputy head of China’s foreign exchange regulator, said at the Boao Forum for Asia, an annual gathering in China’s southern island province of Hainan that is known as the “Asian Davos.”

Premier Li Qiang, China’s No. 2 official, told Cook and other global business executives at the China Development Forum in Beijing on Sunday that China welcomed foreign investment and was taking steps to improve its business environment.

Vice Commerce Minister Guo Tingting also said Monday that foreign companies would be treated the same as Chinese ones so that they “can invest in China with confidence and peace of mind.”

Last week, Chinese officials eased some rules on foreign investment as well as some security rules on the cross-border flow of data, an issue that has concerned foreign companies. Earlier this month, Beijing said it would make access to the manufacturing sector easier for foreign investors.

Sean Stein, chair of the American Chamber of Commerce in China, said that while such announcements were encouraging, “announcements don’t move markets and promises don’t drive investment.”

“The key, as ever, will be full and timely implementation,” he said.

Janis Mackey Frayer reported from Beijing, and Jennifer Jett reported from Hong Kong.